Nantucket House Painter Accused of Diverting $2M From IRS

The owner of a painting business on Nantucket has been charged in a payroll and income diversion scheme that kept over $2 million in payments from the IRS, the office of U.S. Attorney Andrew E. Lelling announced today

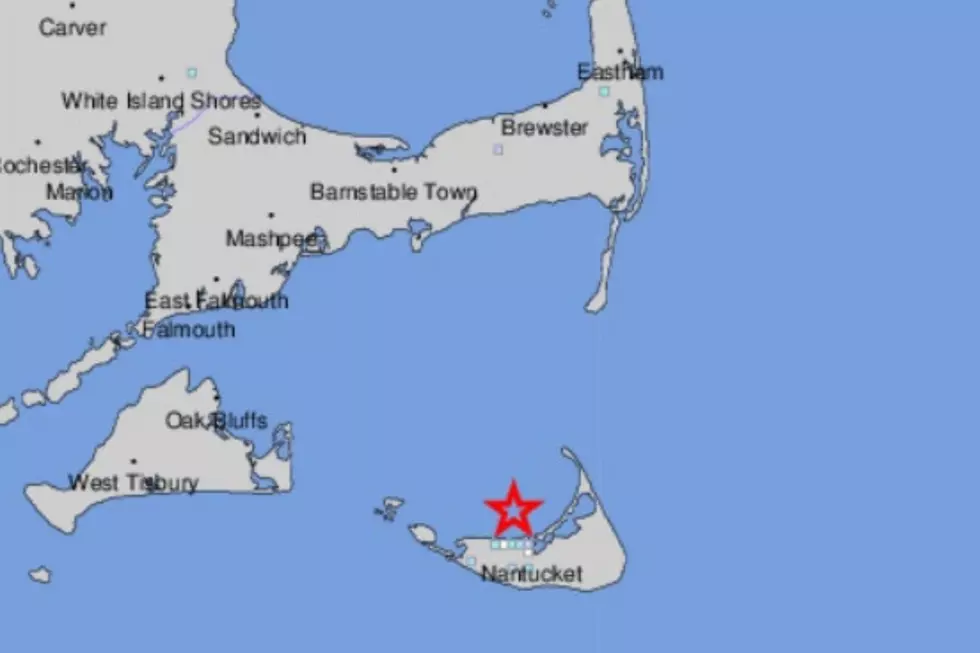

Durvan C. Lewis, 51, of Nantucket, has agreed to plead guilty to one count of tax evasion and one count of failure to pay taxes, Lelling said. A federal court hearing has not yet been scheduled.

Lewis owned and operated DCL Painting. From 2014 through 2017, Lewis allegedly diverted over $1.5 million of the company's gross receipts to his personal bank account and failed to report that revenue to his tax preparer. In addition, Lewis allegedly paid over $5 million in wages to DCL Painting employees in cash “under the table.”

In total, Lewis allegedly caused a loss to the IRS of $2,084,852, Lelling's office said in a news release. The charging statutes provide for a sentence on each count of up to five years in prison, three years of supervised release, and a fine of $250,000 or twice the gross gain or loss, whichever is greater.

Lelling and Ramsey E. Covington, Acting Special Agent in Charge of the Internal Revenue Service’s Criminal Investigation Boston Field Office. made the announcement today. Assistant U.S. Attorney James R. Drabick of Lelling’s Securities, Financial & Cyber Fraud Unit is prosecuting the case.

More From WBSM-AM/AM 1420