Fed Scales Back Stimulus Bond Buying Program

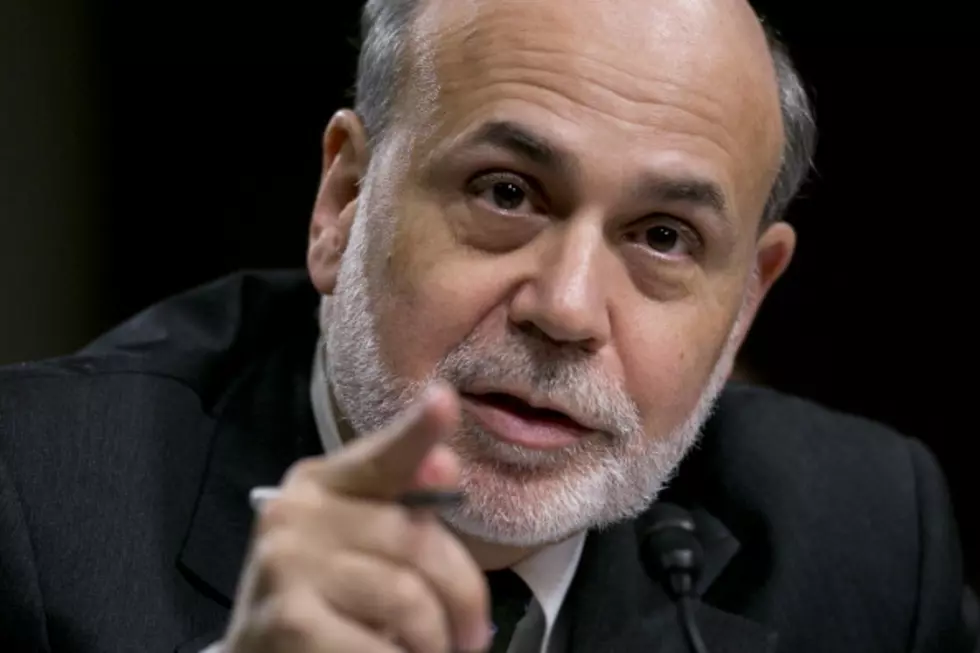

The Federal Reserve is scaling back its stimulus bond-buying program to 75 billion dollars a month. That's a drop of 10 billion a month, starting next month, and signals confidence in the economic recovery. Outgoing Federal Reserve Chairman Ben Bernanke called it a modest move. Interest rates will remain low at zero to a quarter percent.

In his final news briefing as Fed chief, Bernanke cited steady improvement in the job market and the overall economic recovery. He expects continued gains in the labor market in the months ahead and said inflation should remain low. Bernanke thinks the national jobless rate will be down to six-point-five percent by the end of next year. Unemployment currently stands at seven percent.

Bernanke also expects the Fed to keep scaling back the bond-buying program by "similar moderate steps" throughout 2014. Bernanke is retiring next month after two terms running the nation's central bank. President Obama nominated Janet Yellen to replace Bernanke. Yellen, the Fed's vice chair, is awaiting confirmation by the Senate. That is expected to happen this week. Meantime, Bernanke said Yellen "fully supports" the scaling back of bond purchases. (Metro Networks Inc.)

More From WBSM-AM/AM 1420

![A Good Week for Fishing [PHIL-OSOPHY]](http://townsquare.media/site/518/files/2020/07/Imports-1-of-1-29.jpeg?w=980&q=75)

![Massachusetts Senators Support Russian Traitors [OPINION]](http://townsquare.media/site/518/files/2019/08/GettyImages-2659772.jpg?w=980&q=75)

![Pre-Planned Outrage of Mueller Report Says It All [OPINION]](http://townsquare.media/site/518/files/2015/04/FBI-logo.jpg?w=980&q=75)

![The Curious Trump Tower Visit By a Russian Attorney [OPINION]](http://townsquare.media/site/518/files/2019/03/GettyImages-1080368310.jpg?w=980&q=75)

![Senator Warren Not Pure As the Driven Snow [OPINION]](http://townsquare.media/site/518/files/2018/08/GettyImages-1020756502.jpg?w=980&q=75)