State Tax Collections Keep Pouring In

STATE HOUSE, BOSTON, JUNE 20, 2019.....The Baker administration and legislative leaders have so far badly underestimated tax collections this fiscal year, a decision that effectively held spending under affordable levels, resulted in a big deposit into the state savings account, and which will likely lead to a sizeable year-end budget surplus.

The cash windfall continued over the first half of June. Tax collections over the first two weeks of the month totaled $1.375 billion, up $127 million or 10.1 percent versus the same period in June 2018, according to a letter Revenue Commissioner Christopher Harding wrote to lawmakers on Wednesday.

June is the second biggest month of the year for collections, behind only April, and both individuals and businesses make estimated payments this month.

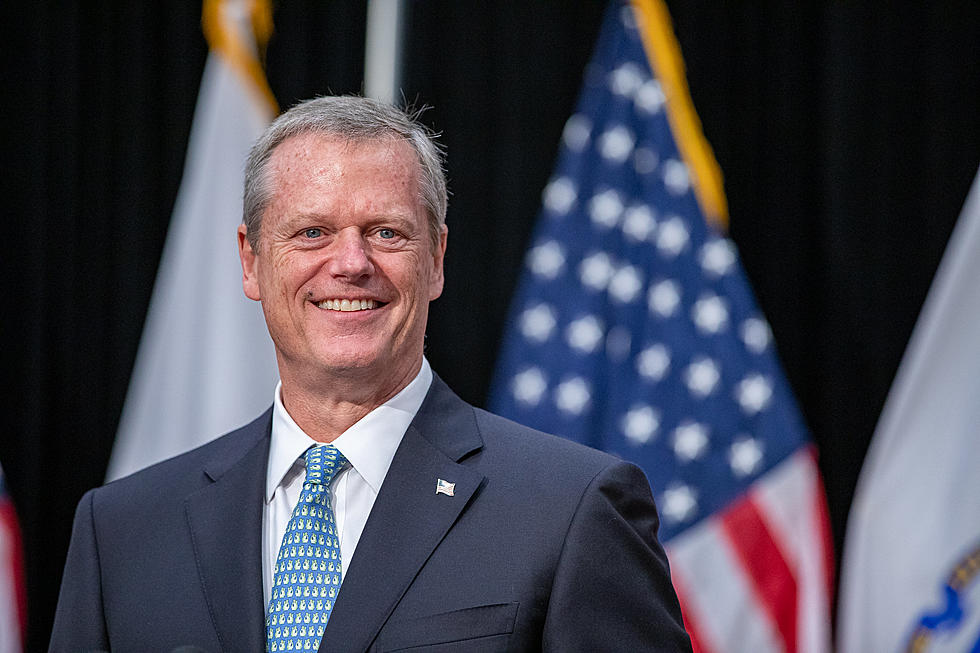

Gov. Charlie Baker in late July 2018 signed a $41.232 billion fiscal 2019 budget that the administration said reflected a 3.2 percent increase in spending and relied on just $95 million in one-time revenues, down from $1.2 billion in fiscal 2015.

Through May, or over the first 11 months of fiscal 2019, state tax collections totaled $26.511 billion, $952 million or 3.7 percent more than the budget benchmark, and $1.873 billion or 7.6 percent more than the same fiscal year-to-date period in 2018.

The growth looks to be continuing into June and puts the pending state budget talks in an interesting context.

The fiscal 2020 budget proposals that Sen. Michael Rodrigues and Rep. Aaron Michlewitz are hashing out in a conference committee are based on an expectation of tax collections growing to $29.23 billion, which officials thought at the time would be a 2.7 percent increase over fiscal 2019 tax revenues. However, if the state this month collects only as much as it did last June, it will have collected $29.67 billion, more than $400 million more this fiscal year than budget writers are counting on the state to collect in all of fiscal 2020.

Economists aligned with the MassBenchmarks initiative cited some caution signs, including tight labor markets, slower global economic growth, and uncertainty over the future of federal government policies.

However, MassBenchmarks concluded that at the moment state economic growth "continues unabated."

"Even the state's Gateway Cities have experienced a steady decline in their unemployment rates, a welcome sign that the benefits of a period of growth that is now in its tenth year are finally being felt outside of the Greater Boston region," MassBenchmarks wrote, summarizing talks among economists. "It does appear that employment growth is slowing both regionally and nationally. In Massachusetts, the slowing job growth is at least in part the result of slowing growth in the labor force, which reflects longstanding demographic trends."

Economists estimated there are 250,000 people in Massachusetts who are working part-time but would prefer to work full-time and who are not in the labor force but want a job and would take one if it were available. This pool of potential workers, however, may not have the skills employers are seeking, the economists said, adding "in this context, federal policies that serve to limit international immigration are particularly unhelpful and poorly timed."

Withholding collection often cited as reflective of how the economy is doing, totaled $629 million over the first two weeks of June, up $119 million from mid-month June 2018. Sales and use taxes, which reflect consumer spending, totaled $101 million for the two-week period, up 16 percent from last June.

Harding this week certified that capital gains revenues for fiscal 2019 through May totaled more than $1.8 billion, resulting in a transfer of $636 million to the stabilization fund, and pushing the balance in that fund up over $2.6 billion. The transfer is made automatically based on capital gains revenues exceeding $1.2 billion, under a state law put in place in recognition that capital gains collections are extremely volatile.

The automatic deposit into reserves reduced the potential revenue surplus for the moment to $805 million, pending June collection results and as long as spending is held in check.

Beacon Hill has already passed several supplemental spending bills this fiscal year.

State officials are in the midst of a long debate over the adequacy of state spending on transportation, education, and other priorities.

Gov. Charlie Baker believes the state can tackle its education and spending needs without new taxes. In addition to planning a debate this session on tax increases and other revenue proposals, legislative leaders are advancing a surtax on household income above $1 million per year that they expect to generate $2 billion

Information from Statehouse News Service

More From WBSM-AM/AM 1420

![Here’s Mud in Your Eye [PHIL-OSOPHY]](http://townsquare.media/site/518/files/2020/08/RS31453_GettyImages-624494724-scr.jpg?w=980&q=75)

![Health Center Offers Free COVID-19 Tests [TOWNSQUARE SUNDAY]](http://townsquare.media/site/518/files/2020/05/Greater-New-Bedford-Community-Health-Center.jpg?w=980&q=75)

![Golf Range Owners Teed Off [PHIL-OSOPHY]](http://townsquare.media/site/518/files/2020/05/RS37632_GettyImages-962754310.jpg?w=980&q=75)