![Massachusetts Lawmakers Consider Sugary Drink Tax Again [OPINION]](https://townsquare.media/site/518/files/2021/10/attachment-GettyImages-1213567351.jpg?w=980&q=75)

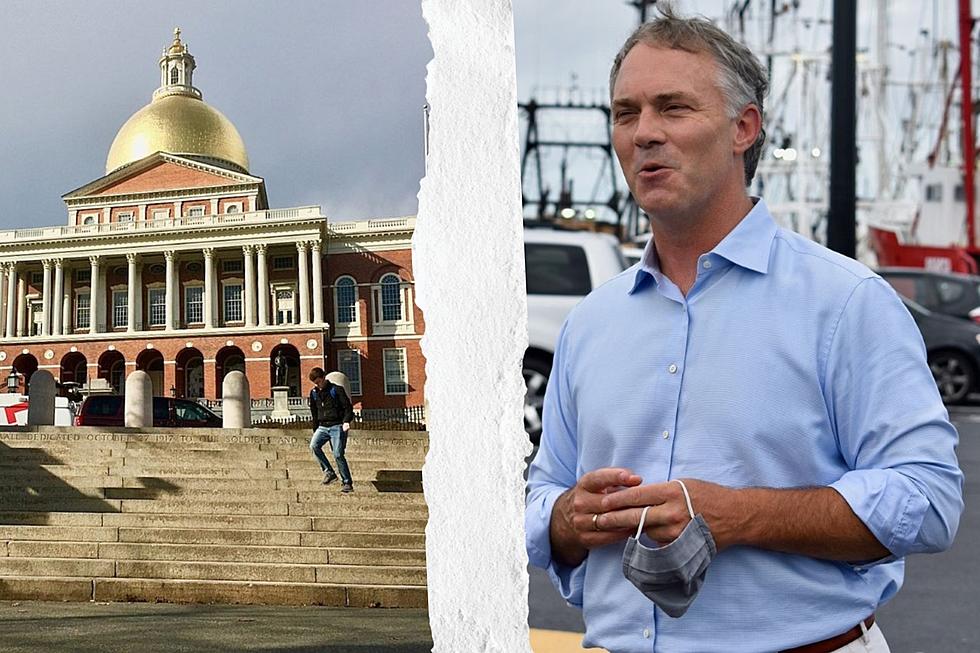

Massachusetts Lawmakers Consider Sugary Drink Tax Again [OPINION]

The Joint Revenue Committee of the Massachusetts Legislature conducted a hearing on Monday on another proposal to impose a tax on sugary drinks. The committee did not vote on the proposal but did hear testimony on both sides.

This is not a new issue. The "nanny staters" going back as far as former Governor Deval Patrick, and perhaps even further, have tried to force this on businesses and consumers before. The idea is to help you to make healthier choices in selecting beverages by imposing an excise tax on distributors of certain drinks with added sugar. Puh-lease!

It's the same con game: impose a new tax on the distributor, who then passes it on to you in the form of higher prices. The state collects at both ends, first from the tax on the distributor and then a higher sales tax paid by the consumer.

Higher prices will simply inspire consumers to shop in Rhode Island, Connecticut, New York, Vermont, New Hampshire, and Maine – states that do not charge an excise tax for sugary drinks. While they are there, they can pick up a few packs of Kool and Salem cigarettes since Massachusetts forbids the sale of menthol-flavored cigarettes, too. Then they can bet on sports, which is legal in all of those states except Vermont.

This is just another ridiculous and transparent money grab and has nothing to do with keeping you healthy. Contact the members of the Joint Committee on Revenue, whose members include Rep. Chris Markey of Dartmouth, and tell them to mind their own business about which beverages you choose to consume.

Tell Markey and the rest of the committee members to vote no on House Bill 2972 and Senate Bill 1914

Barry Richard is the host of The Barry Richard Show on 1420 WBSM New Bedford. He can be heard weekdays from noon to 3 p.m. Contact him at barry@wbsm.com and follow him on Twitter @BarryJRichard58. The opinions expressed in this commentary are solely those of the author.

The 13 Best Foods to Boost Your Immune System to Fight Off COVID-19 Symptoms

More From WBSM-AM/AM 1420